north dakota sales tax nexus

Sales into North Dakota exceeding 100000 or sales were made in 200 or more separate transactions in the current or last calendar year. Economic nexus in North Dakota.

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses

Local sales and use tax rate changes will take effect in the following states on April 1 2022.

. To accentuate this North Dakota had a huge problem with the software. As a corollary to its sales tax North Dakota imposes a use tax upon property purchased for storage use or consumption within the State. Common Ways to Have Sales Tax Nexus in North Dakota.

One of the more complicated aspects of South Dakota sales tax law is sales tax nexus the determination of whether a particular sale took place within the taxation jurisdiction of South. FUN FACTS One of the. North Dakota imposes a sales tax on retail sales.

Nexus is a Latin word that means to bind or tie. The first prong of the Complete Auto test requires a taxpayer to have nexus ie. North Dakota became a full member of Streamlined Sales Tax on October 1 2005.

This overturned a previous ruling Quill v. Ad Do you know where you have sales tax obligations. 298 1992 which required a business to have a physical.

The first general sales tax in North Dakota was enacted at a rate of 2. Effective October 1 2018 North Dakota considers vendors who make more than 100000 in sales in the state in the previous or current calendar year to have economic nexus. The need to collect sales tax in North Dakota is predicated on having a significant connection with the state.

Economic Nexus Threshold. A connection with a state before it can impose its tax jurisdiction. If not you may be out of compliance.

Namely they thought it was eating into their sales tax revenue. Our nexus self-assessment tool can help you determine where to register and collect. Having nexus also known as sufficient business presence with North Dakota means your business has established a taxing connection with a state.

North Dakotas current sales and use tax were enacted in 1977. For the purposes of establishing a sales tax nexus in North Dakota the state interprets the phrase retailer maintaining a place of business in the state to include anyone engaged in solicitation. North Dakota requires every.

The tax base generally consisted of all sales to consumers of personal property. This is a concept known as nexus. North Dakotas economic nexus threshold is gross sales into North Dakota exceeding 100000 in the previous or current calendar year.

Sales and use tax rates in some jurisdictions including the city and. North Dakota Tax Nexus Busineses with nexus in North Dakota are required to register with the North Dakota Department of Revenue and to charge collect and remit the appropriate tax. The sales tax is paid by the purchaser and collected by the seller.

Ad Do you know where you have sales tax obligations. Process Clause nexus requirement that there must be some definite link some minimum connection between a state and the person property or transaction it seeks to subject to a tax. One of the more complicated aspects of North Dakota sales tax law is sales tax nexus the determination of whether a particular sale took place within the taxation jurisdiction of North.

Quill didnt actually have nexus in the. North Dakota sales tax is comprised of 2 parts. North Dakota 504 US.

Sales tax nexus was originally defined in the Supreme Court case Quill v. If not you may be out of compliance. Our nexus self-assessment tool can help you determine where to register and collect.

North Dakota saying that a retailer must have a presence in a state before that state can require the seller to collect. Sales or service of gas electricity. If you had 100000 or more in taxable sales in North Dakota in the previous or.

When this happens you are required. Decision upheld South Dakotas economic nexus statute and overturned its previous decision in Quill Corp. North Dakota which required some form of in-state physical presence by an out-of-state company before that company could be subject.

Sales Tax Nexus 5 Signs Your Company May Owe Taxes In Other States Stage 1 Financial

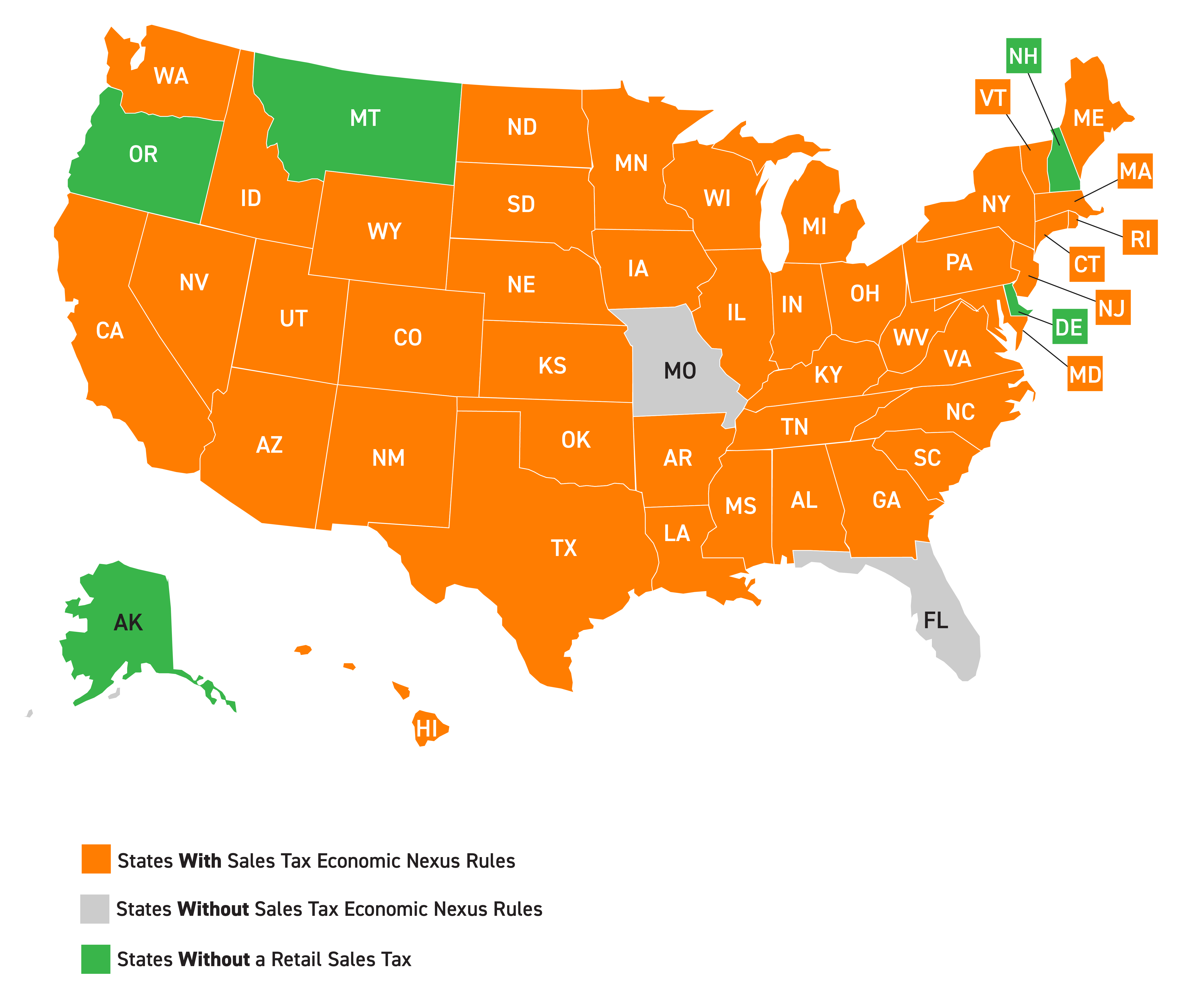

Understand And Buy Economic Nexus By State Cheap Online

Economic Nexus By State For Sales Tax Ledgergurus

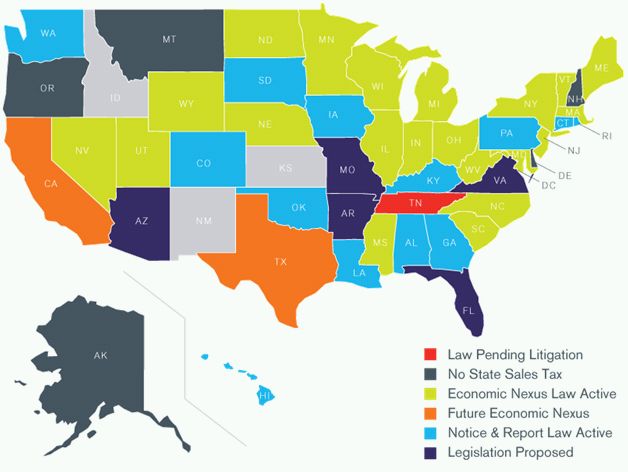

The Current State S Of Wayfair Tracking The New Nexus Laws Across The Country Tax United States

Stripe Understanding Us Sales Tax And Economic Nexus A Guide For Startups

What Do I Need To Know About The Wayfair Case And Economic Nexus South Dakota V Wayfair Faq Sales Tax Institute

The Confusing State Of States Sales Tax Trust Transparency Center

North Dakota Sales Tax Small Business Guide Truic

Economic Nexus And The Future Of Sales Tax Avalara

Economic Nexus Laws By State Taxconnex

Online Sales Tax In 2021 The Impact Of The Supreme Court S Ruling

What B2b Ecommerce Companies Need To Know About The New Federal Sales Tax Laws Blue Fish Sell More And Streamline Operations

State By State Affiliate Nexus Guide Avalara

Sales Tax States Changing Economic Nexus Thresholds Cfo Daily News

Business Guide To Sales Tax In North Dakota

How To Register For A Sales Tax Permit In North Dakota Taxvalet

How To File A Sales Tax Return In North Dakota